"The Cypriots' means of living will disappear."

Russians prepare to quit Cyprus - FT.com

Watch out Spanish banks?

Cyprus to be model for future bailouts

• Cyprus's second-largest bank, Laiki Bank is to be closed.

All lenders to Laiki, including higher rated bond holders, will see their investments wiped out.

Cyprus bailout deal: at a glance

• Bank of Cyprus survives and will be restructured.

The Bank of Cyprus will inherit a €9bn debt Laiki had with the European Central Bank.

Cyprus bailout deal: at a glance

www.cyprus-mail.com

www.cyprus-mail.com"The president 'knew about the possible closure of the banks' and tipped off close friends who were able to move vast sums abroad. Italian media said the 4.5 billion euros left the island in the week before the crisis."

The President of Cyprus warned his friends the week before the surprise announcement of the stealing of everyone's money. / In 2008 pre Euro they were strong, healthy and Prosperous, EU forced them into debt slavery.

http://www.ft.com/

According to Merryn SomersetWebb:

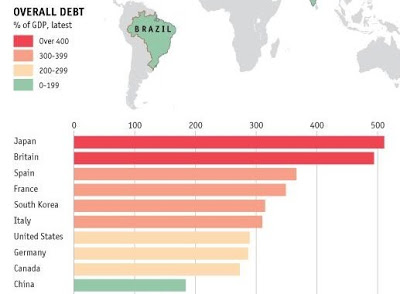

In both Cyprus and the UK, huge debts were built up.

Now we see governments tricking the voters into paying off the debts.

http://www.ft.com/

In the UK (and USA), the situation is covered up by our ability to depreciate our currency and indulge in quantitative easing at will.

http://www.ft.com/

"One of my MoneyWeek colleagues calculated that had your money been sitting on deposit in the UK for the past four years you would now be worse off than if you had kept it in Cyprus" and suffered a deposit tax.

"How so? A toxic combination of ultra-low interest rates and high inflation..."

According to the forecasting group ITEM Club, someone who deposited £10,000 in 2009 will now be sitting on a real terms loss of £1,297.

Save our Savers puts the total cost at just over £200bn (not far off 20 per cent of the value of all the savings in the UK).

http://www.ft.com/

The UK government has been:

1. Keeping interest rates below inflation

2. Cutting real wages

3. Bailing out private debtors

4. Subsidising bank profits

5. Keeping house prices high.

"Savers money is gradually being transferred to debtors."

Government debt will come down over time as inflation eats away at it and more people are dragged into higher tax bands.

http://www.ft.com/

2 comments:

http://www.real-whitby.co.uk/savile-the-jaconelli-ring-and-rampton

Savile - Jersey 1969 Childrens Hospital

http://www.youtube.com/watch?feature=player_embedded&v=Lj2aFMmKKB4

off topic:

Windscale leak??

http://hat4uk.wordpress.com/2013/03/25/smoke-signals-25/

Post a Comment