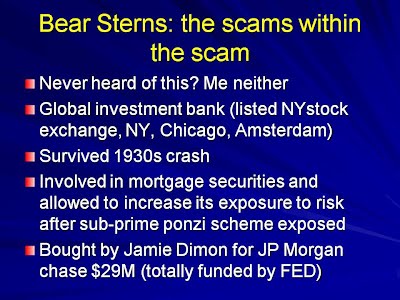

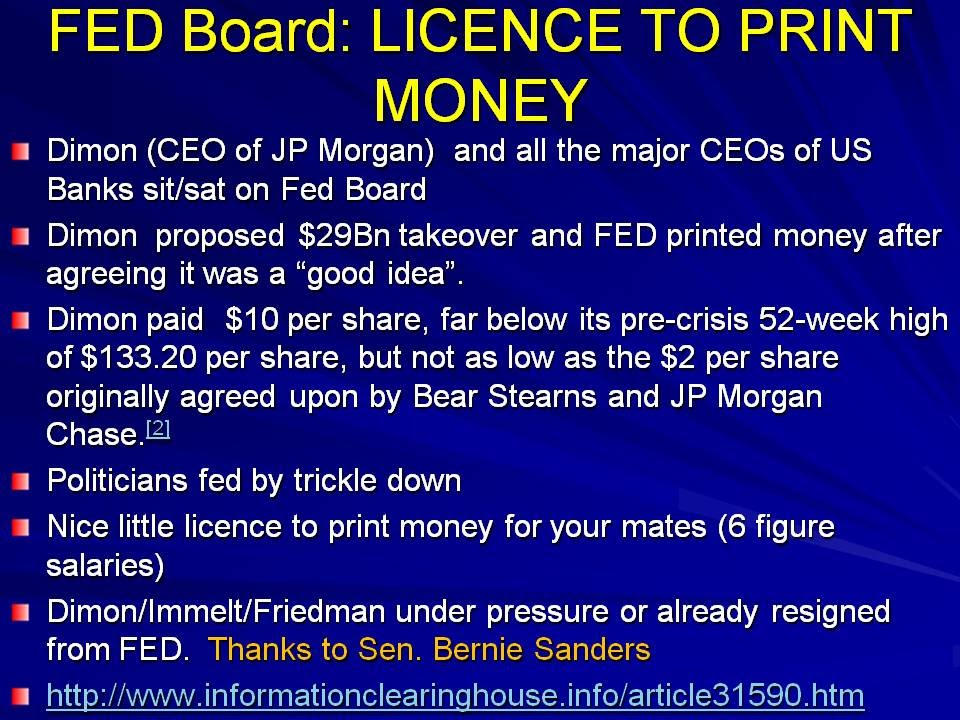

Noam Chomsky G8 leaders SUMMIT 2012 Medvedev President Barack Obama David Cameron Angela Merkel Mervyn King Lagarde Barclay Bush Blair Berlusconi Bernie Saunders Andrew Jackson George Osborne Nick Clegg.JPG THE WHOLE STORY HERE There is a bigger fraud afoot now: recent G8 leaders show every sign of being complicit with a systematic scheme for impoverishing National treasuries, and global citizens, in return for unimaginable wealth for the elite. $16 Trillion Dollar Borrowing and Lending Scam between International Banks (2011 breaking news): Still a secret in Europe One of the worlds most influential and objective academics, Professor Noam Chomsky, who takes a vigorous interest in International affairs, has drawn the worlds attention to a recent (2011) audit of the US Federal Bank2011 FED audit outcomes. Senator Bernie Sanders Inspirational speech 2002 an Independent US politician has bravely campaigned, for over a decade, to expose the greed and corruption within the US banking, political, financial services sectors and to bring the abuses under the radar of financial regulators and the law. Sanders, and a tiny minority of spirited campaigners, fought to expose the cronyism and criminality that means that even hopelessly insolvent banks like Bear Sterns were bailed out (and asset stripped by profiteering bankers and stock holders)* at the say so of CEOs who sat on the FED decision-making boards, then both proposed and approved funding with obvious conflicts of interest. PLEASE PLEASE watch this simple explanatory video→   The magnitude of the US FED loans was a well kept secret even in the USA (Chomsky is aware of the immense political implications of the US administration lending, apparently interest free, to foreign countries and Senator Sanders has been fighting to reduce its impact on US citizens for over a decade). Selected Banks were lent massive amounts of newly created money (and the public in the USA were told they were lent up to $800,000 billion which is similar to the taxpayer funded UK government bailouts across the whole banking/financial services sector UK bailouts:chicken feed):- The audit revealed that the costs to US taxpayers was much much higher totalling $16 Billion US: $16,000,000,000,000 into International Banks trading round the world . The biggest loans were "made in America" but individual European based banks were given sums larger than those injected out of home taxpayers coffers.

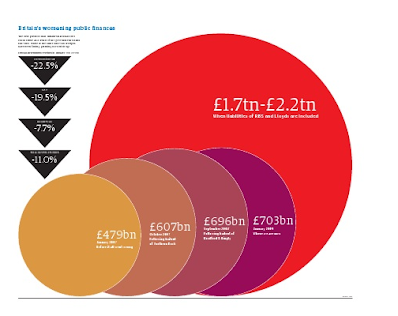

In Chomsky's own words "Americans should be swelled with anger and outrage at the abysmal state of affairs when an unelected group of bankers can create money out of thin air and give it out to megabanks and supercorporations like Halloween candy". "If the Federal Reserve and the bankers who control it believe that they can continue to devalue the savings of Americans and continue to destroy the US economy, they will have to face the realization that their trillion dollar printing presses will eventually plunder the world economy". If one takes alook at the key debtors in this surprising US "gesture" then one immediately sees it is particularly generous to Northern European Banks (who may, at the time, have seemed in a position to reciprocate) in an economically polarised Eurozone and who just happen to be pivotal players in the G8. The way the Fed makes such decisions is fraught with conflicts of interest but the controversial International capital flows are not uniquely out of the USA? The ECB are bundling up bailout fundsLagarde bailout which are being sent overseas (again across the channel to the IMF in Washington ) so the Eurozone crisis can be "fixed" on other continents. The capacity of IMF programmes to cripple national economies is now well documented and the French leadership of the monetary organisation have been accused of acting on behalf of French banks (who underpin loans to European loans to debtor countries and are listed as borrowers in the Fed auditFrench Banks). The magnitude of these funds (being bundled up by EU governments and the ECB ) flowing out of Europe is less mind boggling than $16 trillion lent by the Fed but these schemes and the repeated transient bailouts/govt bonds are now being exposed for their incapacity to solve a borrowing crisis. The conflicts of interest (obvious criminality) and the magnitude of the scheme are huge compared to earlier relatively tiny criminal/fraudulent PONZI schemes exposed relatively recently in the USAStanford $7Bn, Madof:credit default swaps The transfer of money/virtual money across the Atlantic with no economic calibration together with outsourcing jobs and industrial productivity to poorer countries is a chaotic calamity (benefiting only the financial services sectors for very brief periods of hyped-up optimism in the markets). In this culture of catastrophic and subjective policy making the rating agencies have, after months of delay, denounced some of the European banks (as a risk re capital reserves)Downgrades. The impact of RBS & Lloyds liabilities on UK Government revenues have been obvious for some time (see diagram below). The RBS have been downgraded along with Barclays & HSBC rating controversy(several months after risk flags were raised over banks trading in Southern Europe, notably Spain, Italy, Portugal and, of course Greece). These rating agencies operate for profit (two of the three used by International governments are in the USA) and are inevitably political instruments (just like the RBS who have a massive advertising and lobbying presence in UK & European finance and a significance sponsorship budget). Recent flawed decisions in retrospect suggest they are highly error pronerating ratings and RBS now endorse this suggestion vigourouslyRBS indignant. So in June 2012 the British Banks have been exposed (by "outsiders") as insecure. Just weeks before the Spanish banks (which had tried to escape this flytrap by logically Nationalising their struggling banks, borrowing a further 25Bn ) have, so far, escaped austerity measures presumably because they have the goodwill of the G8 leaders (including President Barossol is the current represntatative at the G8 summits). Britain is next in line for this role despite its polarised stance on the EU and European strategic planning (David Cameron has flounced out of recent summits). To all intelligent analysts it is obvious that the countries which have become tied to the Euro and cannot print their own currency are deeply in trouble: they cannot fund public programmes or retain Nationalised assets by quantitative easing. So are we on the right track now? I will let you make up your own mind but you should be aware that not only capital has flowed freely across the Atlantic but we also share the executive expertise. Bob Diamond Jr, a US banker, recently became the CEO of the Barclays Banking group (one of the beneficiaries of the FED lending) and quickly forged a reputation for astute business by buying the remnants of the busted Lehman brothers group in the USADiamond & Lehman brothers. His controversial executive bonuses (months after Fred Goodwin, former CEO at RBS, the biggest player on the FTSE 100 for a time, was stripped of his knighthood) were eventually approved after a shareholders revoltDiamond 17Million pay package. So we are sharing a lot over the pond but Senator Sanders knows who is footing the bill and spreading the contagion across the globalised world. It does not take a deep thinker to grasp the scale of these abuses but you need to make your feelings known to your local and national political representatives (and hope the Sanders/Chomsky in them starts beating the table)! RBS: Impact on UK Government Finances  image source image sourceCOMPLICITY or COCK UP: President Bush in 2008 insisted that National Leaders (not G8 finance ministers) attend the International Summits which are now convened several times all around the globe every year. Since that pivotal moment these problems have escalated although almost all the G8 leaders have changed in the 4 year period. None of the minutes of any of these meetings are published and there is no prospect of a comprehensive audit of global economics. Senator Sanders has describe the financial scandal as war on the middle classes in America. Since 2008, the war has been transformed into "economic genocide" targeting taxpayers/middle classes all around the globalised world. I am asking current leaders to think about the implications of this for their careers, their electorate, their funders, their children and their consciences. Professor Chomsky has strong feelings on modern day Western leadership and war crimes e.g. Imperialist War Crimes ....make your feelings known forcefully but peacefully so that this "war to end all wars" can bring the democratic & prosperous world together. Noam Chomsky G8 leaders SUMMIT 2012 Medvedev President Barack Obama David Cameron Angela Merkel Mervyn King Lagarde Barclay Bush Blair Berlusconi Bernie Saunders Andrew Jackson George Osborne Nick Clegg.JPG |