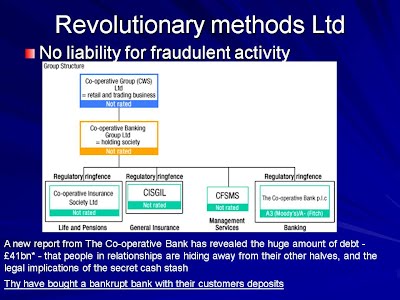

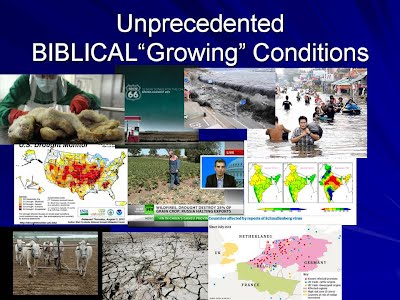

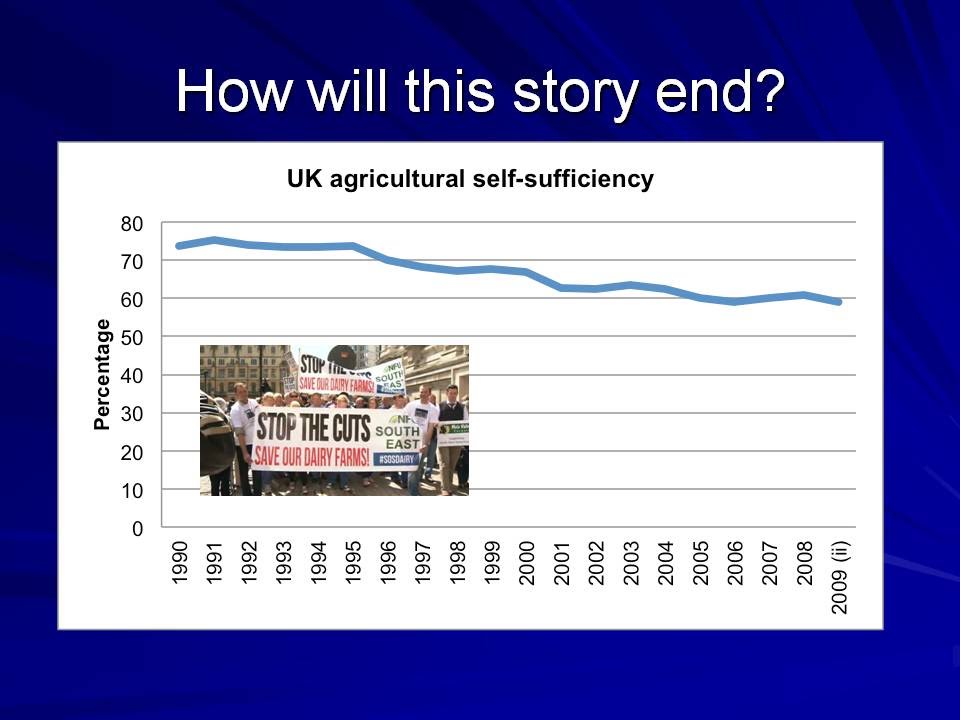

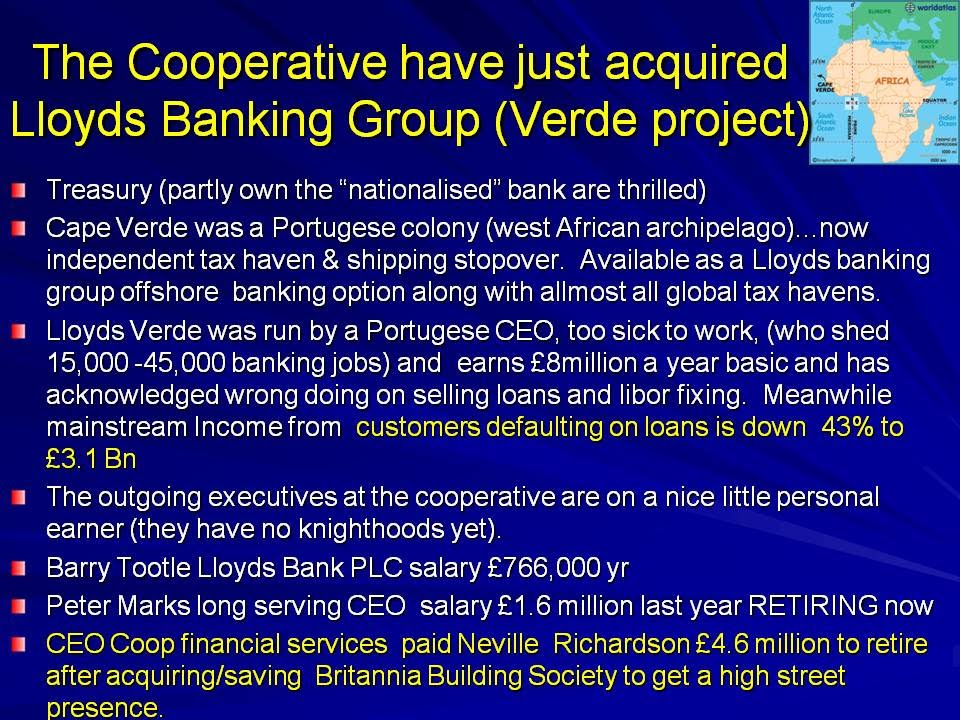

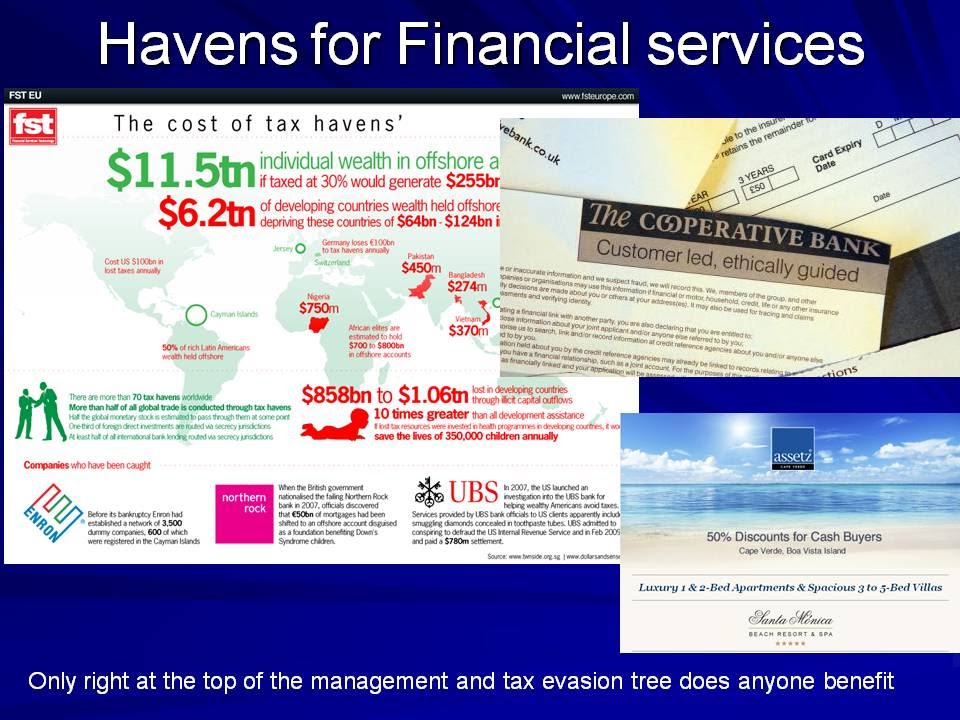

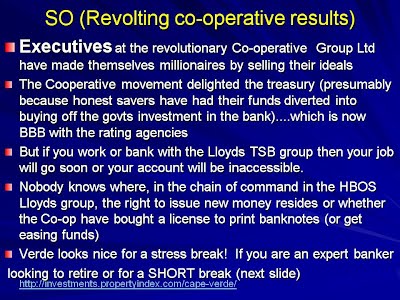

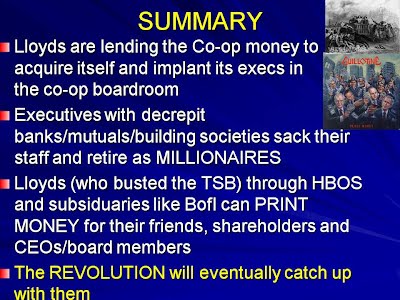

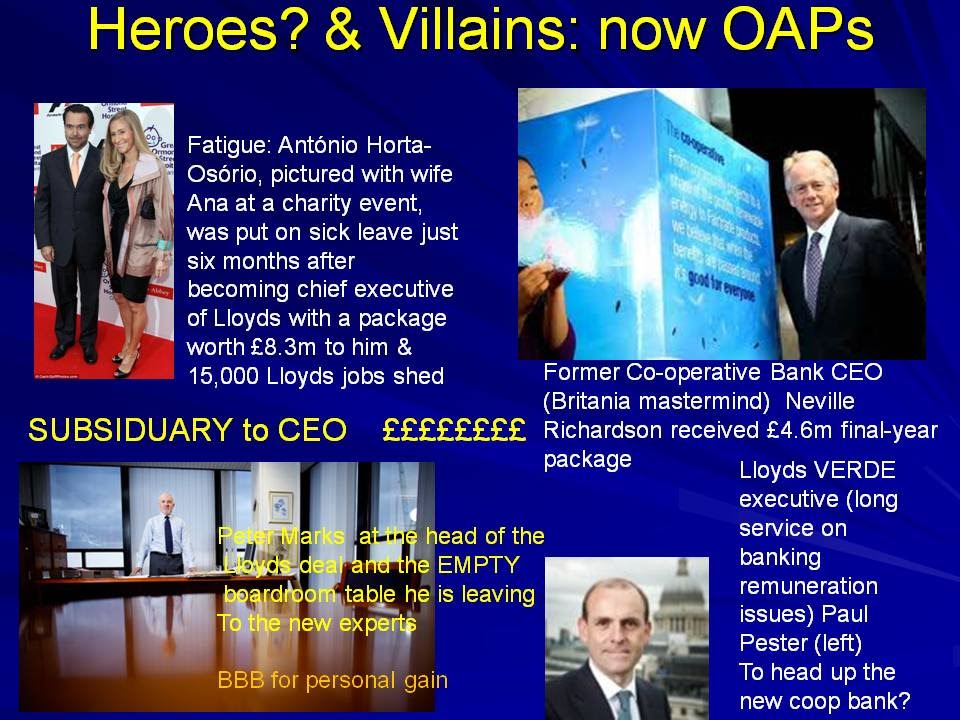

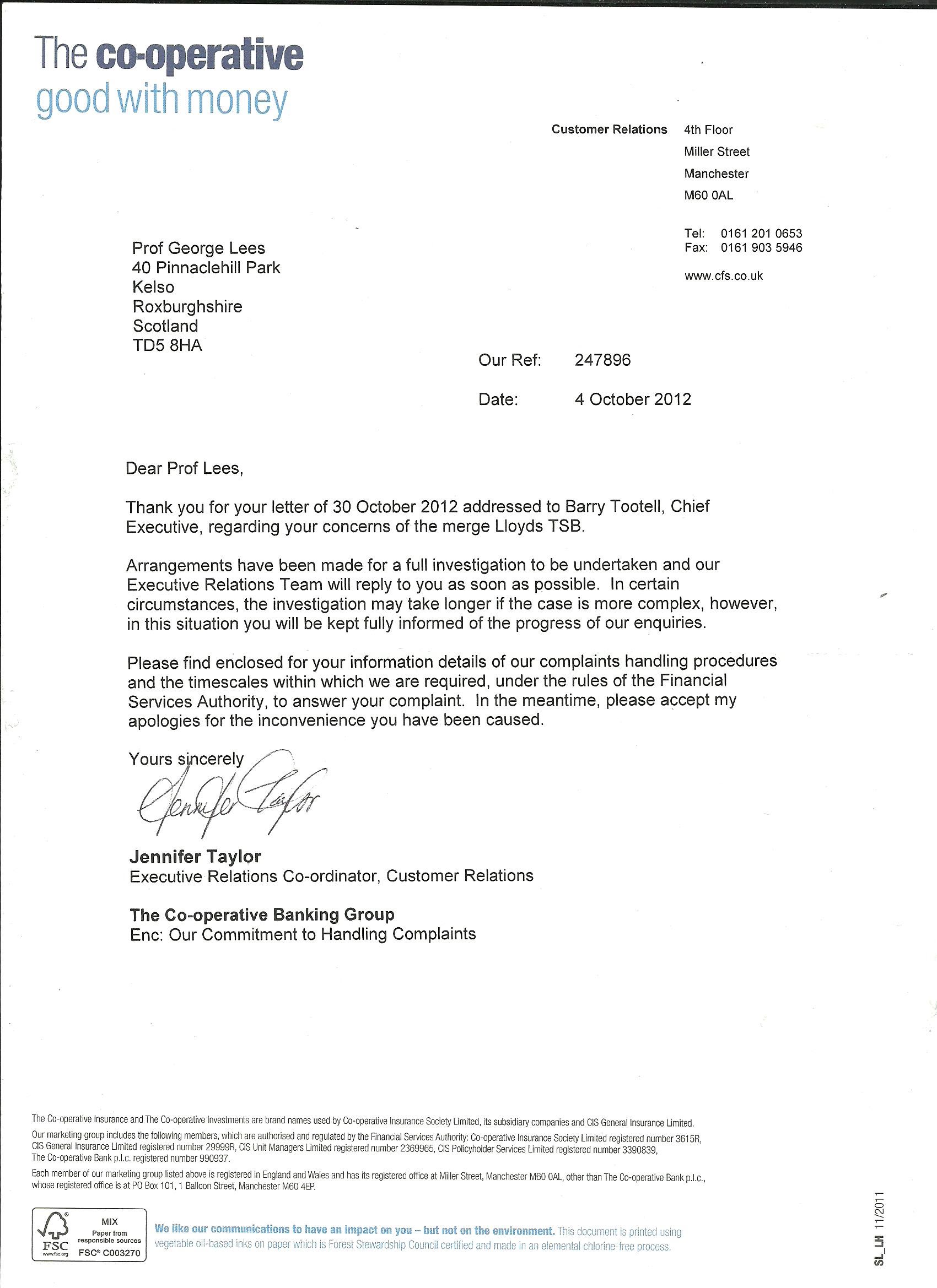

Unfortunately the UK CO-OP has been MODERNISED (at least at the very top of its management structures, see diagram above). They no longer support local initiatives or regional sustainability or buy their retail products/commodities from local suppliers with simple inexpensive logistics. As with all the supermarket giants the CO-OP now fill their warehouses and road wearing Juggernauts with goods from different continents. When America gets drought and wildfires, India's monsoon fails or SE Asia floods as in 2012, the CO-OP (just like Sainsburys, Waitrose, TESCO & all the others) pay for the food products, the distribution costs, the market driven price explosion (and the competition for raw materials, like grain, as alternative sources of biofuelsfilling your tank:better prices for farmers (but much more expensive food products)) and the hedge funds which the farmers now use to insure themselves against natural disasters or waning crop yields. The coupons issued by governmental agencies or stock marketeers to contain these risks and compensate farmers may be made from edible rice paper but they will NOT feed the world! These are generic issues for farmers, distributors and retailers all around the world. The co-operative bank have gradually modernised their systems which means that like every bank that you can access in the high street thay have invested their investors savings in multiple tiers of TOXIC DEBTHigh street presence all taxpayer funded. On your high street?Some of the leadership team challenged the logic of following the other banks on the fraudulent high street pavements but they fell on a gold plated swordpension "in store". Neville Richardson (salary greater than £700,000) who has just received a £4.5M retirement handshake from the Co-operative group was actually the chief executive of the legally dissolved Britannia mutual group which merged with the Cooperative in 2009. Britannia acquired subsiduaries of the Bank of Ireland in 2005 which itself has been the victim of old fashioned robbery and remuneration deals€7 million stolen & €66million in bonuses for its executives that led to bonus packages (leading to fines of €2million) , fraud & mismanagement of customer data, and taxpayer bailouts of €3.5 Bn....quaintly the BofI can print sterling but not Irish Pounds. Between 2007 and 2009 the share price at bank of Ireland fell by 99%bank of Ireland collapse (under PWC's limited liability audit). So Britannia took on some toxic issues under Richardson's watch (then became attractive to the Co-operative bank because of its high street presence and reputation in April of 2009)Britannia members delighted to be acquired by the Co-op. The merger with the Lolyds group has been masterminded by the long serving Peter Marks Marks, Get Set, Go £££££ who has proclaimed the merits of more high street presence then left the boardroom empy by resigning within days of the press release (he has served for 45 years and was earning £1.6 million basic in 2012). One has no insight, yet, into his retirement package. Just wait for the best bit....all the execs at the Co-operative have lined their pockets but they have funded the acquisition by borrowing from the decrepit, publicly owned Lloyd's-TSB group (who they are acquiring)revolutionary daylight robbery. They are playing a game Computers do the thinking? with their investors money and it is CRIMINAL! Spread the word. Radio Four's TODAY program interviewed Peter Marks as news of the Lloyds "acquisition" broke (August 2012) but there was no indication of Mr Mark's intention to quit or that Paul Pester (above) was to head up the new co-operative bank. Nor was it made clear that the new boss would come from Lloyds black horse "stable" who appear to be funding the acquisition of their own bank. The lucrative displacement of the Co-ops long serving boss by an employee of their own company....yes the same Lloyds TSB/HBOS consortium that have been making headlines since 2007 for all the wrong reasons..... continues to lead the sector into dodgy deals for personal gain (right under the noses of Britain's "free press" and its struggling, or knowingly corrupt, political & economic leadership teams). Radio Four TODAY,International News Media, national politicians & the tax-justice network (a well meaning group of financial services experts trying hard to restore funds to national treasuries) were informed of this scam by Email in the last week of August 2012 This is a formal receipt for the complaint sent to "co-op" HQ (on 1st October 2012) in Manchester dated 4th October 2012. A full-investigation into the complaint below has been pledged by Jennifer Taylor (Executive Relations Co-ordinator, Customer Relations). GOOD WITH MONEY? THIS FORMAL COMPLAINT WAS SENT TO THE COOPERATIVE BANK IN MANCHESTER ON 1st OCTOBER 2012 To The Co-operative Bank Prof George Lees CUSTOMER RELATIONS 4th Floor 40 Pinnaclehill Park Miller Street Kelso Manchester Roxburghshire M60 0AL Scotland TD5 8HA profgeorgelees@gmail.com 30th September 2012

Cc Complaints BBC Radio Four TODAY Michael Moore: my MP (and a qualified chartered accountant) George Osborne (Leader of the Totalitarian “Opposition”) Scandal at the Co-op is published in full on my Website: https://sites.google.com/site/profgeorgeleesrevelations/ AND See also George Lees’ Facebook page

Dear Co-operative Bank,

I am an account holder with the bank and I wish to lodge a formal complaint about your CEOs and their criminal abuses in recent weeks. You have acquired 600 new branches of Lloyds TSB (to increase your high street presence). This (the acquisition by an honest bank of a corrupt bank with only “toxic assets”) is in itself a threatening gesture to your customers (who are notionally your shareholders). The transactions of recent weeks have blown you’re concept of a people’s bank right out of the murky water. What actually happened is shameful: Lloyds Verde lent you the money to acquire their own branches (their Verde project). The executives at the co-operative bank (within weeks of announcing their ambitions to enhance the high street presence) retired with £5-6 million in pension funds for themselves. The CEO, Peter Vincent Marks had the barefaced greed to appear on radio four’s TODAY program and explain how this was going to revitalize the retail business but his retirement with the cash (within days) was not discussed. Even before Marks took the lead, CEOs at the co-operative bank were earning massive sums. The new CEO at the co-operative (Paul Pester) is a very experienced Lloyds TSB executive who has for a long time sat on the brazenly corrupt Lloyds-TSB remuneration board and helped to pay people like Antonio Horta-Osorio £8 million in basic salary with a fundamental goal of shedding 15,000 jobs at his own bank. Horta-Osorio has been “unfit for work” for a significant period but this scam suggests his mind is very much focused on enhancing the profits of the bank no matter how ruthless the methods. So, effectively, Lloyd’s TSB have acquired the Co-op through the back door and now have their corrupted experts all around your REVOLUTIONARY boardroom table. It is a scandal and will be an important step in bringing down your corrupt sector. One hopes that, in future, the bank can be run by genuine staff who work with ,and for, your customers (as well as to retain jobs and restore the REPUTATION of the sector). The honest employees have a rosy future and the “expert” current leaders will see their vicious mistakes from behind bars when honesty and conscience kicks in. I await your reply (and on behalf of those who are too busy keeping their important jobs I demand immediate affirmative action). PLEASE CONFIRM RECEIPT Sincerely and Concernedly Yours George ProfGeorgeLees, Kelso, Scotland |